Isio Private Capital: Private credit – Why now?

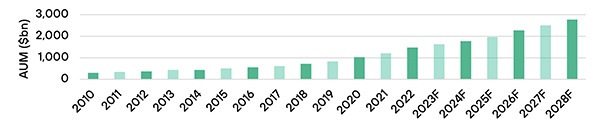

Assets under management have grown significantly among Private Credit funds, alongside the types of investment opportunities which investors can consider. We are currently observing continued tailwinds for Private Credit, which we detail as key themes within this report.

We see Private Credit as one the key cornerstones of a private market portfolio, believing it is a compelling asset class for investors to consider. We also look across the spectrum into where we think the best opportunities are for investors in this asset class, as well as how we believe investors should approach implementing Private Credit in their portfolios.

Background

The 2008 Global Financial Crisis was one of the most significant economic crises in recent history, causing economic destruction across the world. Following the crisis, banks considerably pulled back from lending, which was in part driven by the introduction of stricter regulation aimed to promote greater financial stability. This led to the increasing prominence of Private Credit, which is the provision of debt finance to companies not issued via public markets.

This has led to a boom in private lending, allowing institutional investors to take advantage of a wide range of new opportunities. Private Credit does not just focus on directly originated corporate loans, also known as ‘direct lending’, but also covers a much broader opportunity set, including infrastructure and real estate backed deals.

We believe that this Private Credit market represents a diverse, established area of investing, with plenty of attractive options for investors to consider.

Global Private Credit AUM

Global private credit markets have growth substantially post-crisis

Where would Private Credit sit in your portfolio?

We believe Private Credit can be used as a portfolio return driver to complement other existing growth allocations, such as Private Equity. An important difference between Private Credit and Private Equity is that the returns of Private Credit are largely driven by income, providing investors with greater certainty of future return outcomes, due to the contractual nature of return profile. Private Credit also benefits from up-front origination fees as an additional source of return.

Private Credit encompasses an ‘illiquidity premium’ which means as an investor, you are compensated for locking up assets for a period, typically between 5-10 years depending on the strategy. This allows long term investors to benefit more from greater yields, than what could be feasibly achieved on equivalently rated public liquid credit assets. For a significant proportion of family offices we work with, they have the scope to take illiquidity in their portfolio, due to their long term investment horizon.

Investing in Private Credit also brings diversification benefits relative to traditional public assets, due to its focus on various alternative borrowers, such as the origination of deals with mid-market companies. However, as with any credit asset held in your portfolio, one of the main risks to navigate is default risk. Whilst thorough underwriting is an obvious mitigation of this, Private Credit also has additional covenant agreements, enforcement rights and seniority in the capital structure to limit potential downside risk. Carefully assessing a manager’s capabilities in sourcing, underwriting and structuring deals are key to navigating this risk.

Why now?

1: Bank Disintermediation – a key theme which has underpinned Private Credit since 2008. We continue to see increasing regulatory restraints on bank lending, which is forcing banks to both reduce new lending and offload existing loans – even if they are performing positions. This offers a great opportunity for other investors to gain access to attractive assets outside of traditional, public markets.

2: Expansion – as Private Credit has grown in influence, so has the total addressable market for funds to target. As an example, initially, loans were aimed towards mid-cap companies, but this has recently expanded to offering financing to larger corporates. Other examples include bespoke lending agreements secured by various tangible assets, this can improve diversification through different issuers and loan types. This also expands the range of funds available for investors to access.

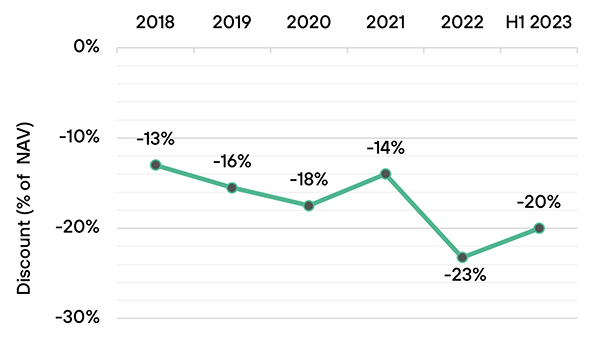

3: Liquidity – many investors are currently liquidity constrained as they grapple higher interest rates and cash requirements. For instance, we are seeing a number of institutional investors which are overweight private assets - and need to rebalance in order to return to their strategic target. This offers an enhanced opportunity set for investors with longer time horizons to enter the market, with current discounts levels of c.20% relative to net asset value of the fund.

Private Credit Fund Secondary Pricing

Discounts have continued to expand driven by liquidity constraints

4. Dislocation – the impact of rising interest rates and continued regulation is creating pricing dislocations within private markets. For instance, we are seeing a significant opportunity in commercial real estate, whereby there is up to c.£2trn of loans needing to be refinanced by 2028 at significantly higher rates. A large proportion of these loans are held by regional banks which may be forced to offload some of these loans at a significant discount.

How could you implement?

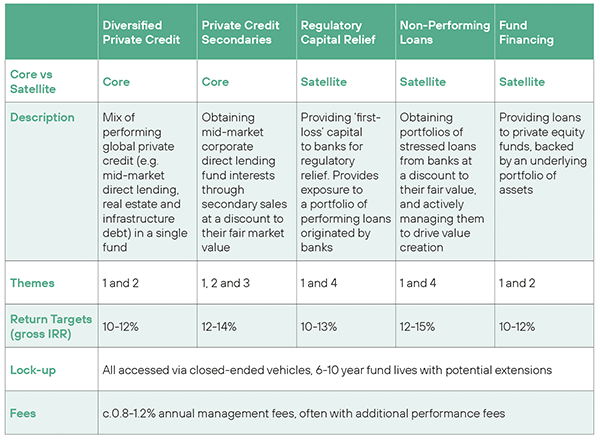

For investors seeking to gain exposure to this asset class, we advocate combining a core private credit allocation of performing bonds with ‘satellite‘ allocations to more niche areas to access both the strategic and tactical benefits of Private Credit.

Typical components of each are as follows:

To summarise, we believe Private Credit is an attractive asset class which offers many appealing aspects to investors - such as diversification, contractual income and notable investment returns. We believe the investment case is augmented by the current market environment, which is providing a tailwind to the industry. We expect the Private Credit space to continue to grow significantly and to see continuing innovation.

Contact Rob Agnew, Partner, isio Private Capital on rob.agnew@isio.com for more information.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

This document is issued by Isio Services Limited who are authorised and regulated by the Financial Conduct Authority (FCA), Firm Registration Number: 922376. This document is intended solely for distribution to Professional Clients for the purposes of the FCA’s Handbook of Rules and Guidance and should not be relied upon by any other person.