Fortunes favour family businesses in Rich List of billionaires

Ultra-wealthy family businesses dominate the new Sunday Times Rich List, with the combined wealth of family firms in the top ten totalling £58.7 billion ($75.9 billion).

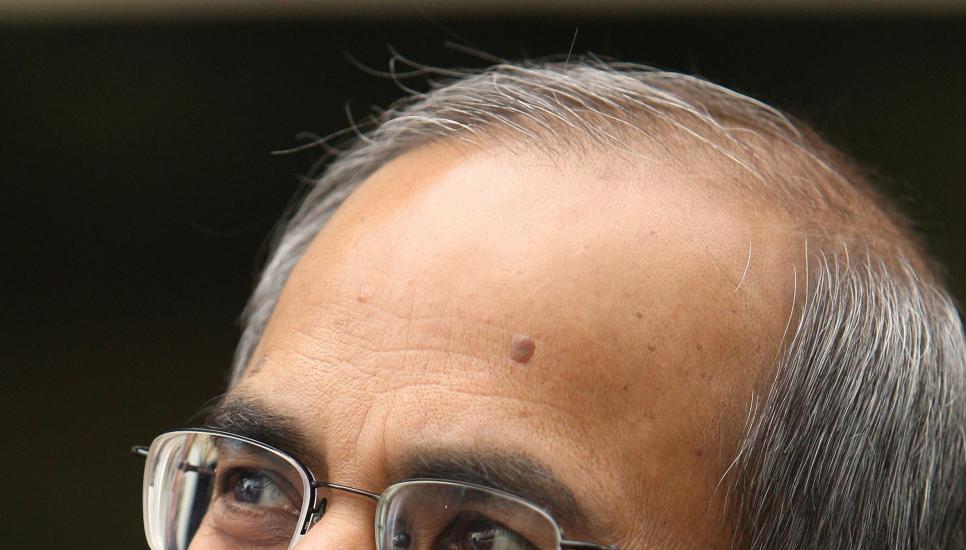

The number one spot was taken by industry and finance titans Sri and Gopi Hinduja, with their fortune of £16.2 billion ($20.9 billion), up £3.2 billion ($4.1 billion) on last year. The 81 and 77-year-old brothers inherited and built upon their late father's 103-year-old business empire in Mumbai, India. The Hinduja Group invested in multiple sectors, including energy, banking and property, and employs 70,000 people. Its main British company, Hinduja Automative, has Gopi as its chairman and generated more than £2 billion in 2015-16 with £237.8 million net assets.

Ukranian-born investor Len Blavatnik (59) is in second place on the list with £15.982 billion ($20.6 billion). Mumbai-born, property and internet tycoon Reuben brothers, David (78) and Simon (76), took third place with £14 billion ($18.1 billion) then another major family business featured in fourth place.

World leading steelmaker Lakshmi Mittal (66, right) and family saw their wealth rise by £6.109 billion to £13.229 billion. Mittal's son Aditya and daughter Vanisha sit on the board of the Luxembourg-based integrated steel and mining company ArcelorMittal.

Uzbek-born investor and mining tycoon Alisher Usmanov (63) was in fifth place with £11.791 billion, followed by a former family business in sixth place. Italian-born Swiss businessman Ernesto Bertarelli (51), married to Kirsty Bertarelli (45), Britain's richest woman, are worth £11.5 billion. Bertarelli's family sold its biotech firm Serono in 2006 for £13.3 billion and made £8.6 billion, the Rich List reported.

British brothers Guy (56) and George (53) Weston, with Irish cousin Galen Junior Weston (44), ranked seventh at £10.5 billion, the only entrant in the top ten to experience a year-on-year decrease in fortune, by £500 million. The Westons' food, retailing and charitable operations span North America and Europe but shares in their Associated British Foods, incorporating household brands Kingsmill, Twinings and Primark, have slumped. Read our family portrait here.

Inherited wealth helped eighth-place getters and siblings Kirsten (64) and Jorn (57) Rausing enjoy £9.66 billion. The Swedish family Rausing owns the Tetra Lavel packaging group, which made more than £10 billion in 2015-16.

Rounding out the top 10 are two more family businesses: The Duke of Westminster and his property owning Grosvenor family in ninth place then Charlene de Carvalho-Heineken (62) and investor husband Michel de Carvalho (72) in tenth place.

Hugh Grosvenor (left, 26) became Britain's youngest billionaire with £9.52 billion when his father Gerald died aged 64 in August 2016. One of seven trustees of the Grosvenor Estate, the family owns 300 acres of some of London's most exclusive real estate and its Grosvenor Group made £527 million in profit in 2015.

Hugh Grosvenor (left, 26) became Britain's youngest billionaire with £9.52 billion when his father Gerald died aged 64 in August 2016. One of seven trustees of the Grosvenor Estate, the family owns 300 acres of some of London's most exclusive real estate and its Grosvenor Group made £527 million in profit in 2015.

The daughter and son-in-law of the late Freddy Heineken, whose grandfather launched their eponymous $37 billion Dutch brewing empire, in 1873, have £9.3 billion to their name, with group profits buoyant.

The Hinduja brothers were on top of the pile of 134 billionaires in Britain. The Sunday newspaper's 29th edition of the Rich List declared Britain's “super-rich have been supercharged by a 'Brexit boom' with record wealth and more billionaires than ever before” on the list.

This year's 500 richest individuals were found to be richer than all the top 1,000 were in 2016.

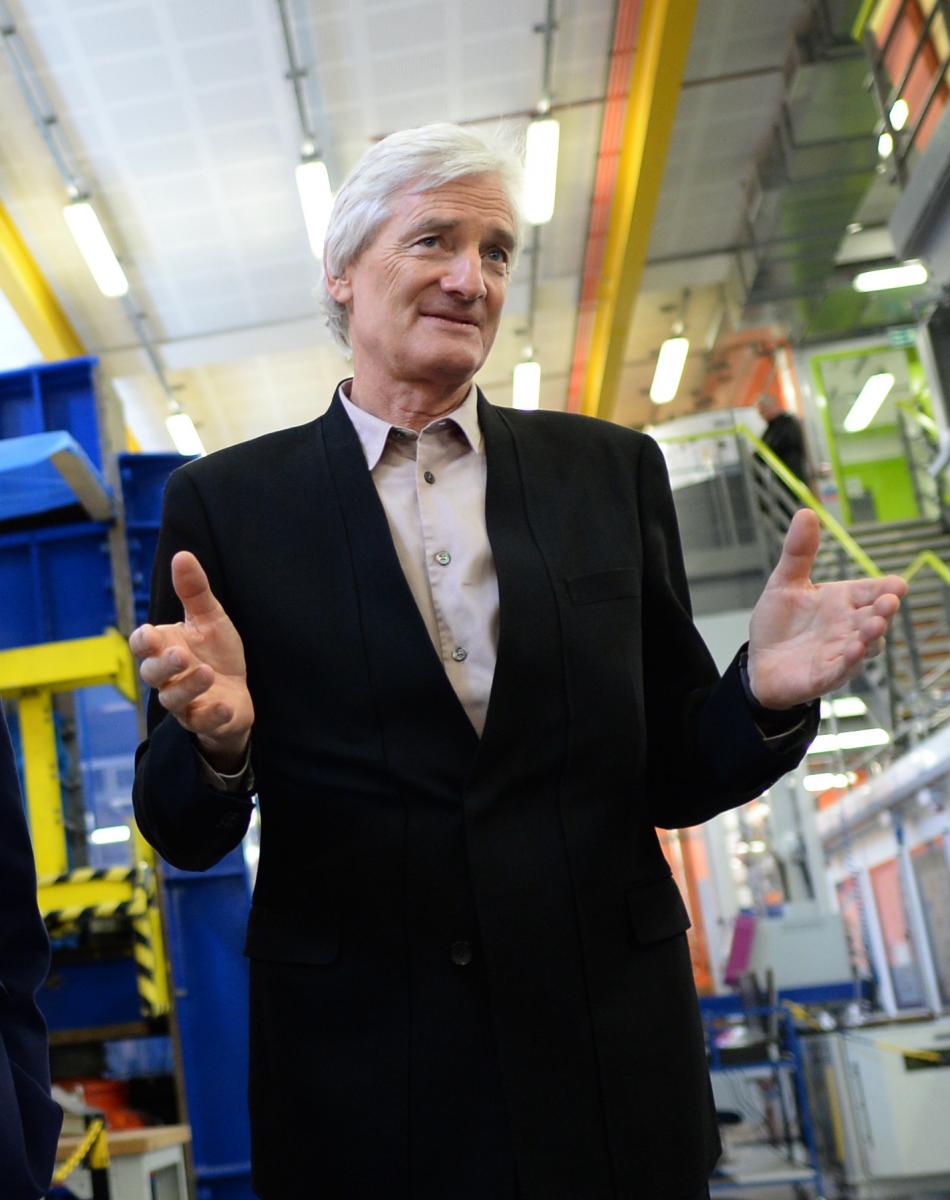

Brexit champion and tech entrepreneur Sir James Dyson (below) was among the 19 British billionaires who saw their fortunes rise by more than £1 billion within 12-months. Dyson's wealth shot up from £5 billion in 2016 to £7.8 billion this year, the list said.

“The total wealth of Britain's 1,000 richest individuals and families soared to £658 billion ($851.2 billion)–a 14% rise on last year,” the Rich List reported.

“The combined wealth of the top 500 of the Rich List surged to £580.3 billion ($750.7 billion) more than the £575.6 billion ($744.6 billion) total wealth of the 1,000 richest people in 2016.

The phenomenal level of wealth and the often senior age of wealth holders underscored the urgency of organising clear succession plans to secure their fortunes and provide for their families.

The Global Family Office Report 2016 warned family office succession was a “looming challenge” with 43% of the world's family offices expected to make a generational transition in the next 10 years and 69% in the next 15 years.

The latest RBC Wealth Management survey, in collaboration with Scorpio Partnership, warned the lack of inheritance plans could have broad societal and economic implications, with Americans transferring an estimated $3.2 trillion over the coming years.

A total of 3,105 American, Canadian and British business owners, wealthy professionals, entrepreneurs and retirees, with an average net worth of $4.5 million, were surveyed in June and August 2016.

A mere 30% of high-net worth Americans and 24% of high-net worth Britons said they had a full wealth plan in place for how they will pass their assets on to next-gens.

While 54% of Americans and 47% of Britons have a will, another 30% of Americans and 30% of Britons said they had done nothing to prepare the transfer of their estate to heirs. This was despite more than half of parents surveyed (58%) were confident their fortunes will endure with their children with a wealth transfer strategy fully in place.