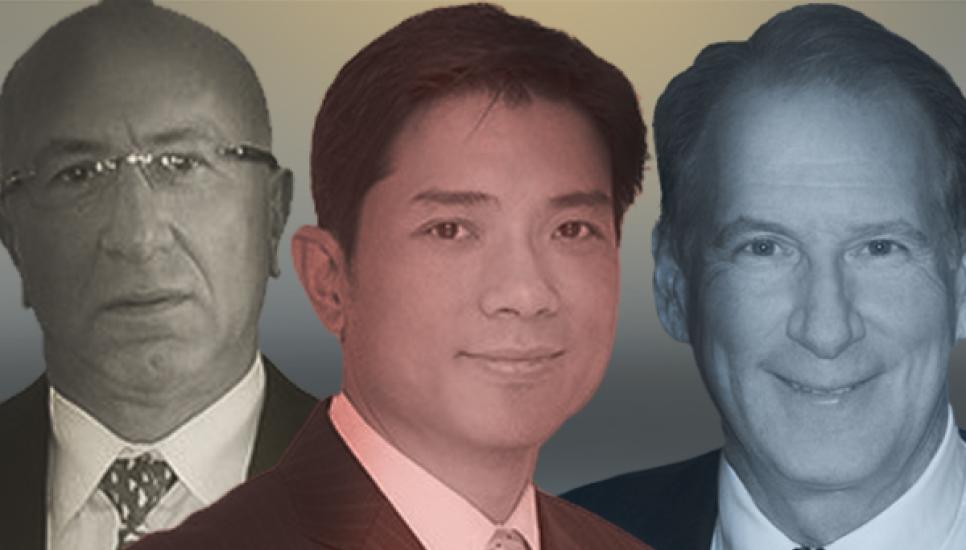

FB Roundup: Turgay Ciner, James Crown, Robin Li

Ciner family gets set for major London IPO

Ciner family gets set for major London IPO

The family of Turkish industrialist and founder of the Ciner Group, Turgay Ciner, are in line for a £650 million increase in their collective net worth by floating one of their companies on the London Stock Market.

The 67-year-old Ciner, who has built up an empire worth an estimated $1.6 billion across mining, chemicals, shipping, media and football, is presenting WE Soda (the world’s largest producer of natural soda ash, which is used in glass manufacturing) for an initial public offering (IPO) that is expected to value the company at up to $8 billion.

“Despite the challenging market backdrop, we’re confident of a successful listing,” said WE Soda chief strategy and risk officer Nicholas Hall talking to The Standard. “The FTSE 100 is associated with quality and prestige and given that history it seems the right place to list. Investors are seeking quality companies with defensive characteristics.”

WE Soda, which is chaired by Turgay Ciner’s wife Didem (a London School of Economics graduate), is “also exploring an offering to retail investors of up to £7 million in shares, the maximum permitted under European rules” (reports Yahoo! News), which, says Hall, is because “an important investment opportunity should be open to everyone.”

According to The Evening Standard, “WE Soda generates five million tons of natural soda ash annually across two facilities in Turkey, and proceeds from the IPO will be used to fund its $5 billion investment into building two new sites in Wyoming, USA, in a bid to more than double production”.

“WE Soda’s intention to list on the London Stock Exchange is a boost for the City just as the capital has been left reeling from some high-profile names which have opted for the bright lights of New York instead,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown. “By describing the FTSE 100 as being associated with quality and prestige, the company has provided a ray of light for London, with the LSE’s defensive characteristics considered a benefit at a time of uncertainty due to soaring inflation and high interest rates.

“The stock market launch of the industrial materials maker will be the FTSE’s first major IPO this year, but although this is a much-needed drop in a parched landscape, it’s still unlikely to lead to a flood of immediate listings due to the still volatile nature of market sentiment. Nevertheless, it brings a wash of confidence to London, and raises hopes that the City can capitalise on the UK’s entrepreneurial activity in the sustainable solutions sector.”

James Crown reveals plan to reduce city crime rate

James Crown reveals plan to reduce city crime rate

Chicago-based billionaire James Crown, the president of family investment firm Henry Crown & Company, has put a call out to company bosses to find jobs for thousands of people in an effort to cut the city’s high rate of murder and violence.

Crown, whose family was ranked 34th-richest in America in Forbes’ 2020 Rich List with an estimated net worth of $10.2 billion, has announced “a crime reduction strategy focused on getting jobs for thousands of people in the most dangerous parts of Chicago, providing millions of dollars for civilian violence intervention programmes, strengthening law enforcement agencies and investing in low-income communities,” according to the Chicago Sun Times.

As leader of the Civic Committee of the Commercial Club of Chicago, Crown has spearheaded research and interviews with former mayor Lori Lightfoot, former Chicago Police superintendent David Brown, Cook County sheriff Tom Dart and numerous criminal justice system figures, to investigate how to reduce crime in the city’s poorest areas.

“Historically, the Civic Committee has not been involved in public safety matters,” said Crown. “I’ve got to say this with real humility: We’re late to the conversation. We’re late to the understanding of some of these things.”

“You’ve got altruism,” Crown said on the subject of compelling the business leaders to act. “But you’ve also got the enlightened self-interest of: I want to be safe, I want my workers to come to work, I want the tourists to patronise my business, whatever that might be.”

Crown - who is chairman and chief executive officer of his family’s investment business, Henry Crown & Company and a director of General Dynamics and JPMorgan Chase - cited the financial cost of violence, which, according to a 2019 estimate by the University of Chicago, amounts to $1.5 million for each of the thousands of people a year are attacked in Chicago. His goal, according to the Chicago Sun Times, “is to bring the number of murders in Chicago to under 400 a year over the next five years and below 200 in a decade.”

“We came up with those numbers because, adjusted for population, it’s what’s been achieved in Los Angeles and New York,” said Crown, comparing Chicago’s yearly murder total, which hasn’t fallen below 400 since 1965, to New York, which has a population three times Chicago’s and had 433 murders in 2022.

Robin Li reveals fund to help Chinese generative AI startups

Robin Li reveals fund to help Chinese generative AI startups

Chinese software engineer and billionaire internet entrepreneur Robin Li has announced a $140 million fund to give a helping hand to Chinese startups that explore generative AI, through Baidu, the search engine which he co-founded.

Joining a global investment gold rush following a rise in interest in ChatGPT-like services, according to The National, “China’s internet search leader will use the pool to establish projects built on top of its AI model, in deployments as high as ten million yuan apiece.”

Baidu and its VC partners will welcome pitches from prospective founders who’ll use Baidu’s ChatGPT response Ernie Bot to build out their own services after security reviews have been approved by China’s internet regulator.

“Large-language models will give birth to AI-native applications,” said Li. “Baidu will become the first company to rework all of its products. It’s not about integrating or accessing AI. It’s about rework and restructuring.”