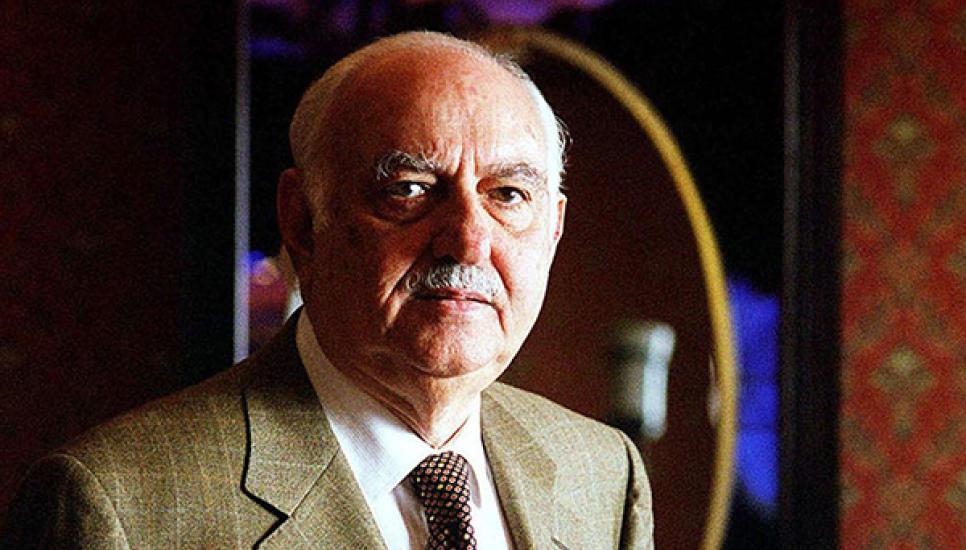

FB Roundup: Pallonji Mistry, Tim and Tom O'Connor, Alberto Safra

Tributes paid to Indian billionaire Pallonji Mistry

Prime Minister Narendra Modi has led tributes to construction tycoon Pallonji Mistry following his passing at the age of 93.

“[I am] saddened by the passing of Shri Pallonji Mistry,” Modi said on Twitter. “He made monumental contributions to the world of commerce and industry. My condolences to his family, friends and countless well-wishers.”

The Indian-born billionaire grew an empire comprised of luxury hotels, factories and stadiums across Asia - including the Reserve Bank of India, Mumbai’s Oberoi Hotel and the Sultan of Oman’s Al Alam Palace.

Mistry, who had a net worth of almost $29 billion (according to the Bloomberg Billionaires Index), ran the Shapoorji Pallonji Group, which was formed more than 150 years ago by his grandfather and employs more than 50,000 people in over 50 countries. Most of the family wealth, however, came from being the largest minority shareholder (18.5%) in The Tata Group, India's only value-based corporation, with which Mistry was locked in a long-running and public feud.

Born in Mumbai in 1929, Mistry joined the family business in 1947, eventually leading the company’s expansion into the Middle East and beyond.

Despite having adopted Irish citizenship after marrying his Dublin-born wife Patsy, Mistry was latterly awarded the Padma Bhushan (the third highest civilian award in India) in 2016 for his services to industry.

Family-owned OCU Group sells to Triton Partners in £400 million deal

A multi-utility services company founded in Greater Manchester by two brothers in 1994 has been sold to investment firm Triton Partners in a deal worth £400 million, according to Sky News.

OCU Group Limited (OCU), the holding company of O’Connor Utilities and Instalcom, was established by brothers Tim and Tom O’Connor [pictured right] and has a workforce of more than 3,000 employees and contractors across the UK operating within regulated infrastructure markets, including electricity, rail, water, gas and telecoms.

“The acquisition by Triton Partners marks the end of an exceptional 30 years of ownership by the O’Connor family,” said Michael Hughes, chief executive of OCU Group. “Tim and Tom have been phenomenal stewards of the business and we are thankful for all they have done. As we look ahead, our focus is on ensuring that the business continues to grow and evolve, whilst also maintaining the strong culture and approach to customer service that they have instilled, and which remains our key differentiator.”

“The growth and evolution of the O’Connor Utilities and Instalcom businesses represents over three decades of hard work and commitment to create a successful and industry-leading business,” said Tim and Tom O’Connor in a joint statement. “It is a bittersweet moment as we say goodbye to many friends amongst our colleagues, customers, and suppliers, without whom the business would not have achieved the success it has.”

“Tim and Tom O’Connor have built an exceptional business, balancing profitability with purpose and we are delighted that the OCU Group will join our portfolio of companies,” said Matthew Turner, senior industry expert at Triton Partners, which was founded in 1997 and has 12 offices around the world with a current portfolio of companies collectively valued at more than €18 billion. “We have spent a lot of time with Michael and the wider management team and have been impressed by their vision for the future direction of the company. We have full confidence in their ability to execute the journey they have planned.”

Brazilian billionaire Alberto Safra aims to sell stake in family empire

Brazilian billionaire Alberto Safra aims to sell stake in family empire

Alberto Safra, one of four children of the late Lebanese-Brazilian billionaire banker Joseph Safra, is reportedly looking to sell his stake in the family's multi-billion-dollar empire to his brothers, potentially ending one of the biggest inheritance disputes in recent history.

Alberto, who created ASA Investments after leaving his family's bank in 2019 and has subsequently launched several products, including a hedge fund and multi-market quantitative, equity and fixed-income strategies, wants to sell his share as part of an ambitious plan to turn his own family office into one of the biggest in Latin America.

According to Bloomberg, the sale of his stake in the business could add $5 billion into his investment firm over the course of a decade. Under the terms of the proposed deal, Alberto would be barred from creating a new bank to compete with his brothers.

Due to covering multiple jurisdictions, negotiations are expected to be ongoing for some time, but a deal would bring about the end of a dispute that started following Joseph Safra's death in December 2020.

The Safra family's fortune, which was founded more than 180 years ago and has grown with the establishment of Banco Safra in Brazil, Safra National Bank of New York in the US and J Safra Sarasin in Switzerland, as well as real estate including the ‘Gherkin’ building in London and 660 Madison Avenue in New York, has been under scrutiny following a contested succession plan.

Until October 2019, Alberto was responsible for corporate banking at Banco Safra. He left his position following a dispute with his brother David over the bank’s expansion into retail banking.

In 2021, he challenged three new wills his father executed in 2019. Joseph Safra passed away in 2020 leaving his wife and children approximately $7.3 billion each, according to the Forbes list of The World's Billionaires.