FB Roundup: Nordstrom, Porsche, and Ofer family

Nordstrom ends talks with founding family

Nordstrom have ended discussions with its founding family over re-privatising the business, following 10 months of negotiations.

The fashion retailer had appointed a committee to negotiate with the family—who own just over 30%—on behalf of shareholders, but the parties had been unable to reach an agreement and this week Nordstrom announced it had “terminated” discussions.

“The special committee took this action because it could not reach agreement with the [family] group on an acceptable price for the company,” the company said in a statement.

The family had planned to buy back the company, first publicly listed in 1971, using debt and with the help of a private equity partner. Earlier this month the group of sixth, fourth and third generation family members offered $8.4 billion for the outstanding shares, which was rejected.

The retailer achieved record sales of $15 billion in 2017, but lagged slightly on analysts’ earnings expectations.

Porsche put next-gen in the driver's seat

Porsche is expanding its governance to include the next generations of its controlling families, taking its supervisory board from six to 10 members.

Porsche Automobil Holding SE controls Volkswagen AG and is the holding company of Germany’s Porsche and Piech families.

Porsche Automobil Holding SE controls Volkswagen AG and is the holding company of Germany’s Porsche and Piech families.

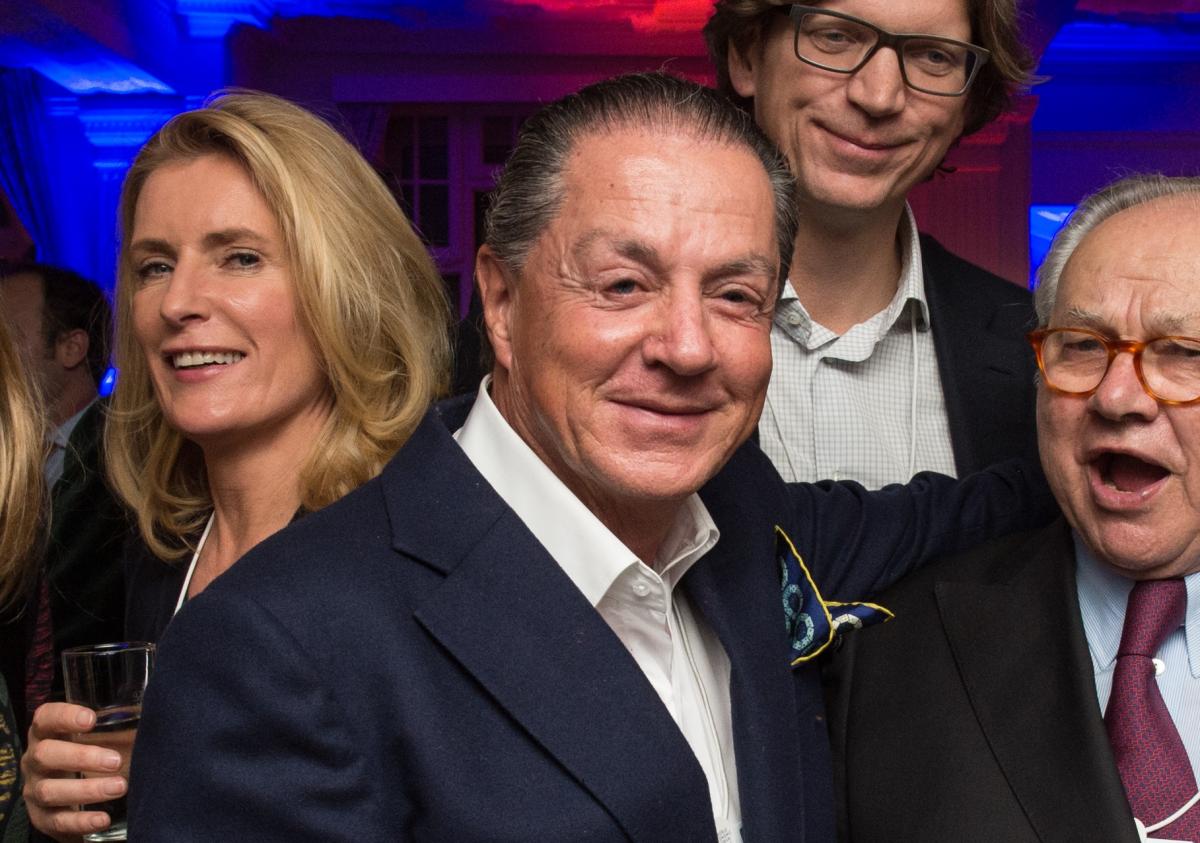

Hans-Peter Porsche (pictured), 77 and the grandson of the VW Beetle designer, will resign at the next annual general meeting, while fourth generation family members Josef Michael Ahorner, Stefan Piëch and Peter Daniel Porsche are set to be elected. The board also plans to elect several non-family advisers.

The group's profit increased 143% year-on-year in 2017, to €3.3 billion ($4.1 billion), following a record sales year at Volkswagen. Volkswagen AG’s brands include Audi, SEAT, ŠKODA, Bentley, Bugatti, Lamborghini, Porsche, and Ducati.

Ofers divide assets to avoid competition law

Israel’s Ofer family have found a loophole in a law designed to increase market competition and curb the power of the country’s largest holding companies and family dynasties.

Israel’s Business Concentration Law, passed in 2013, bans holding groups from owning both financial and non-financial businesses, dismantles multi-tiered holding structures, and supposedly prevents a single tycoon or family wielding too much power. Existing businesses have until 2019 to reach compliance, by selling off assets to meet the requirements.

Israel’s Business Concentration Law, passed in 2013, bans holding groups from owning both financial and non-financial businesses, dismantles multi-tiered holding structures, and supposedly prevents a single tycoon or family wielding too much power. Existing businesses have until 2019 to reach compliance, by selling off assets to meet the requirements.

But the Ofer family have found a work-around, by swapping their assets among family members. Liora Ofer will control real estate firm Melisron and its parent company Ofer Investments, while her cousin Eyal (pictured) worth an estimated $9.6 billion, will retain the family’s share in one of Israel’s largest banks, Mizrahi Tefahot.