FB Roundup: News Corp, Benetton, and Lundin Petroleum

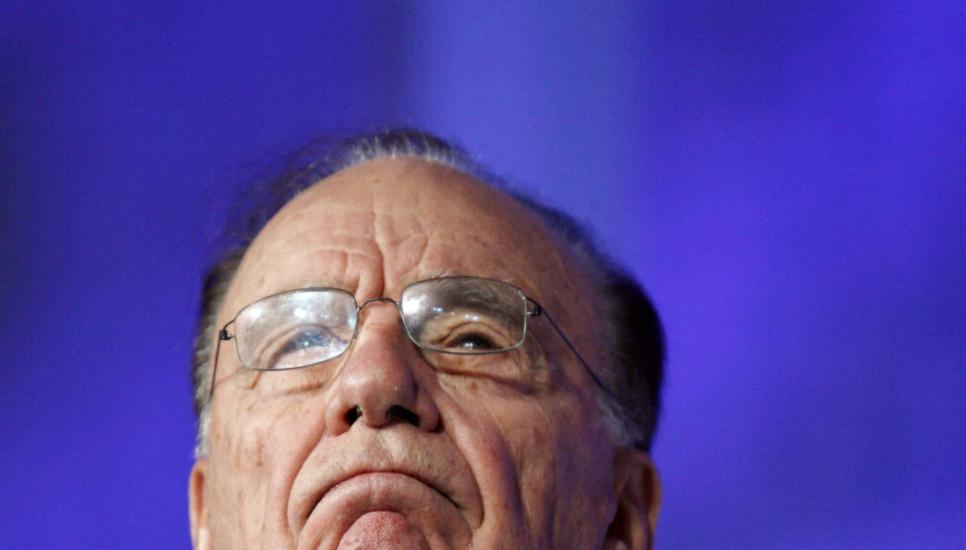

Murdoch loses $100 million on Theranos investment

Australian-American media mogul Rupert Murdoch, chairman and CEO of global media holding company News Corporation, is expected to lose the $100 million he invested in beleaguered blood testing group Theranos.

Murdoch, who purchased his stake when Theranos' valuation was at the $9 billion mark, is likely to notice the irony after his own financial paper, The Wall Street Journal, played an instrumental role in questioning the reliability of its blood testing device.

Murdoch won't be the only one to lose money: several large investments from family-operated companies helped Theranos raise $632 million in its latest round of funding, according to documents filed by Theranos in Arizona and Delaware.

Family-backed investors named in The Wall Street Journal article include Riley Bechtel, chairman of construction business Bechtel Group, who stepped down from the Theranos board this week citing health concerns.

Cox Enterprises, the family-controlled American conglomerate based in Atlanta, also made a large investment, according to the Journal.

A recent lawsuit filed by investor Robert Colman, co-founder of investment firm Robertson Stephens, could lead to a class action suit.

Benetton heir quits board

Alessandro Benetton, the son of one of the founders of the Italian fashion brand, has left the Benetton Group board.

The 52-year-old has been a member of the board for 18 years and was previously chairman of the board of directors from 2012 to 2014.

The board called the heir's exit part of the regular rotation of the board, but union members are reported to have raised questions over the company's future, according to the Associated Press.

Alessandro Benetton is the son of Luciano Benetton, one of four siblings who launched the brand that became known for colourful knitwear and provocative advertising campaigns in the 1980s and 1990s.

Benetton posted revenues of $1.5 billion in 2015.

Lundin Petroleum announces Barents Sea discovery

Family-owned oil and gas company Lundin Petroleum, controlled by the eponymous Swedish family, said on Tuesday that it has made a multi-million barrel discovery in the Barents Sea.

Lundin's wholly-owned subsidiary Lundin Norway discovered the well and is expected to produce between 25 and 60 million barrels of oil.

The company, which is 24.5% owned by the eponymous family, said that the Børselv prospect is a candidate for drilling in 2017.

It has set its development, appraisal and exploration budget for 2015 at $1.08 billion.

Lundin Petroleum was founded in 2002 following the takeover of Lundin Oil AB, and had revenues of $569 million.