FB Roundup: Comcast, Louis Dreyfus Commodities, and Versace

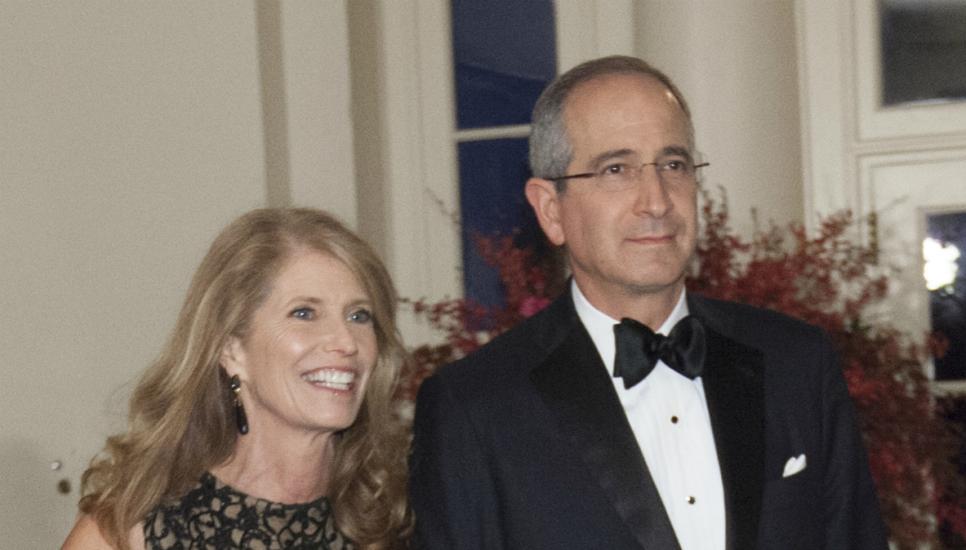

Comcast wins bid for Murdoch empire’s prize asset

Second-generation media giant Comcast has won the battle to acquire the Murdoch family’s satellite broadcaster Sky with 21stCentury Fox (21CF) also agreeing to sell its remaining stake to Comcast.

The Roberts family own 33% of Comcast’s voting stock, and 1% of its common stock, while 21stCentury Fox (21CF) is controlled by the Murdoch family, who own 39% of the voting stock and 17% of the equity.

Comcast won an auction process last week to acquire the European pay television group by agreeing to pay £17.28 ($22.61) per share, outbidding Disney-Fox’s £15.67 offer, and ending Rupert Murdoch’s 30-year association with Sky.

It follows the Murdoch family’s decision to sell most of its entertainment and overseas assets in 21CF to Walt Disney for $71 billion which has already been approved by shareholders and the US Department of Justice.

Comcast was founded in 1963 by Brian’s father, Ralph Roberts, along with Daniel Aaron, and Julian Brodsky. The Roberts family controls one-third of the shareholder votes in the company.

21CF’s revenue was $28.5 billion last year, while Comcast turned over $84.5 billion.

Seventh time lucky for Louis Dreyfus Commodities?

Seventh time lucky for Louis Dreyfus Commodities?

Family-controlled conglomerate Louis Dreyfus Commodities (LDC) has named its seventh chief executive in eight years after its current head resigned suddenly.

Gonzalo Ramírez Martiarena spent three as chief executive of the privately-held company, and left “to pursue other opportunities” after 13 years with the company. He is to be replaced by Ian McIntosh.

LDC has also appointed a new chief financial officer after its former financial head Armand Lumens left “for personal reasons”.

The shock departures of two senior executives is likely to fuel speculation around ongoing family to non-family disagreements with majority owner Margarita Louis-Dreyfus who controls 80% of the trader.

Louis-Dreyfus, widow of fourth-generation Robert Louis-Dreyfus whose family founded the firm in 1851, is chairwoman and majority shareholder of Louis-Dreyfus Holding, the business's holding company.

Revenues at the group, which trades everything from coffee and grains, to juice, sat at $43 billion in 2017.

Versace family sells out to Michael Kors

Versace family sells out to Michael Kors

Iconic Italian fashion brand Versace has been sold to US-based luxury group Michael Kors – the latest in a series of deals in the family-dominated luxury sector.

The Versace family, led by Donatella Versace, along with her brother Santo and daughter Allegra, have agreed to sell the 40-year-old family business to Michael Kors for $2.12 billion.

The new entity is to be renamed Capri Holdings with the Versace family receiving €150 million ($175 million) of the purchase price in Capri Holdings shares.

The deal is the latest in a series of family-linked luxury business deals for Michael Kors.

In July 2017 it bought the luxury shoe brand Jimmy Choo, made a household name in the 2000s by television shows including Sex in the City, from JAB Holding Company.

JAB is the investment vehicle of Germany’s billionaire Reimann family.

Versace posted annual revenues of €668 million in 2017.