Accessing emerging transition opportunities in private markets

Private markets—an opportunity to support the transition to a low-carbon and climate resilient world, whilst providing financial rewards

In the midst of a coronavirus pandemic, investors have been exposed to the reality that the global economy can be brought to a halt by a large-scale unpredicted event. A comparison can be drawn with climate change, now widely recognised as a large systemic risk that will affect the global economy, and one which may affect investment portfolios in ways we can’t yet fully imagine or predict.

Climate change has become one of the main sustainability issues for investment portfolios. Investors are increasingly aware that greater climate variability and more frequent extreme weather events could have considerable effects on businesses. There is now wider recognition that the world must transition from a fossil-fuel-based economy to a low-carbon economy imminently.

The carbon emission obligations established under the monumental Paris Agreement of 2015 have gone largely unfulfilled and are at risk of failing. Countries are now racing to implement mandates, which is creating significant demand for the development of renewable energy assets and the requisite enabling infrastructure. This policy support is generating demand for renewable energy infrastructure, leading to an opportunity for investors to create attractive financial returns partnered with positive environmental and social outcomes. However, the wide diversity of investment opportunities, where both winners and losers will arise, highlights the need to navigate with caution to mitigate the potential pitfalls.

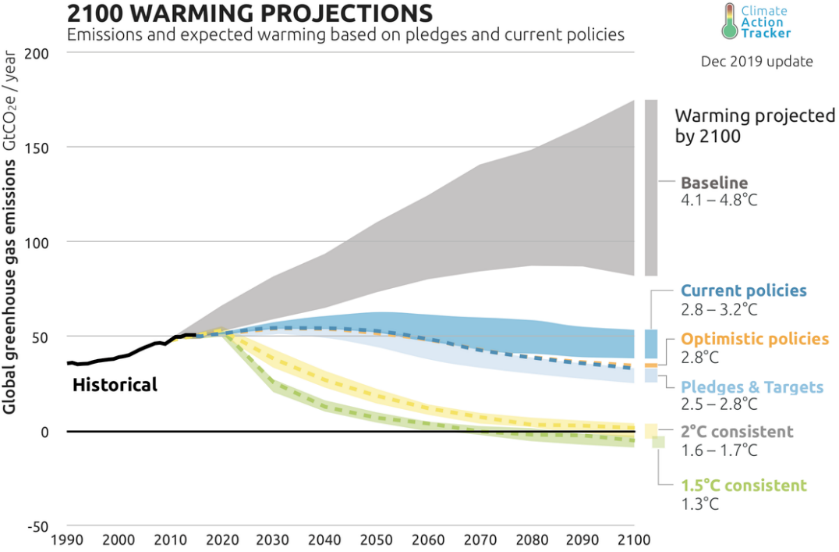

Source: https://climateactiontracker.org/global/temperatures/

Committing capital to combat climate change via private markets

The private sector has seized the opportunity to plug these climate crisis funding gaps and benefit investors. Not only can private markets offer compelling opportunities in terms of risk/return profile, but they enable strong influence over capital from a project standpoint. This makes it a robust channel for targeting positive impact on environmental and social causes, including climate change.

In order to achieve the Paris Agreement target and limit the potential increase in global temperatures as shown above, there will be a requirement to undertake significant incremental spend on renewable energy. Acceleration of technological, economic and policy drivers is expected to require more than $13 trillion (1) which will need to be invested in new power generation assets by 2050, of which 77% is expected to come from renewables.

Why invest in climate transition strategies now?

Why invest in climate transition strategies now?

At Russell Investments, we have been working with investors since 2015 to align social and environmental outcomes with financial reward through impact investing strategies. We are now seeing significant momentum building for climate transition strategies due to the following:

An increase in attractive investment opportunities: The transition to a new energy system will generate a wealth of opportunities within the renewable energy universe looking to capitalise on the aggressive targets to reduce carbon footprint and deliver more sustainable energy.

Future long-term projected investment needs: We are seeing the most attractive opportunities within infrastructure and technology assets. These assets specifically target the slowdown of global warming, including wind and solar, as well as more niche opportunities; storage solutions, renewable natural gas, carbon sequestration, electrification, and climate resilience.

Futureproofing your portfolio: Allocations to climate infrastructure can enhance investor portfolios by generating cash yield, providing diversification, and serving as a hedge against dislocations amid the transition to a lower-carbon economy.

Investing in making a difference: Investing in private markets can offer a more specific and targeted deployment of capital, as well as allowing for the expression of priorities and beliefs. For those with specific Environmental, Social and Governance (ESG) objectives, investing in private markets can be a strong channel to achieve measurable social and environmental impact, alongside any potential financial returns.

Where do we see opportunities to capitalise on this increase in investment required to meet global targets?

In order to achieve the greatest degree of impact as well as delivering financial return, we operate with a thematic approach to private markets. The three themes which we believe will make the biggest difference towards climate change mitigation are the following:

1. Energy revolution: Whilst renewable energy only accounts for 26% of total generation today, the technologies continue to benefit from steeply declining learning curves—the cost of solar energy is down 89% since 2009 and wind 70%. This cost reduction, improved technological enhancements and support from energy policy, the expectation is that renewable energy will make up 50-65% of power generation by 2050.

2. Decarbonisation of industry: The replacement of fuel sources is needed to support the climate transition and renewable natural gas and methane are key vectors. Opportunities exist within bioenergy, carbon capture and to a limited extent, hydrogen.

3. Incremental electrification: Efficiency comes not just from how energy is supplied, but also how it is used. Various factors including 5G, energy efficiency, electrification of infrastructure and transport are expected to dramatically drive demand for electricity.

What do investors need to consider prior to making an allocation to impact strategies?

When investing in climate transition strategies we take a holistic perspective and first principles approach using our multi-manager structure. We utilise a wide range of instruments and research, exploiting market inefficiencies and providing greater portfolio risk-return than standalone allocations. Furthermore, a multi-manager approach provides access to a diverse set of opportunities across the full spectrum of climate-change focused investments, without being restricted by an internal skillset.

Whilst we believe that private market investments can diversify risk, generate alpha and provide cash flow, it is important to watch for the tripwires as there are many complexities associated with investing in private markets, including; regional differences, illiquidity, and lack of transparency. The plethora of opportunities and risks highlight why it is important to partner with talent that has access to an elite operating partner network and possesses highly aligned professionals who can source opportunities, all of which will be crucial to success as the renewable energy asset class broadens and matures.

At Russell Investments we believe that responsible investing is a long-term approach that accounts for a wide range of complex factors. We have a firm commitment to ESG, with a robust process embedded throughout our business and investment process, including manager research and active ownership.

(1) Source: BloombergNEF, New Energy Outlook 2019

Unless otherwise specified, Russell Investments is the source of all data. All information contained in this material is current at the time of issue and, to the best of our knowledge, accurate. Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

Unless otherwise specified, Russell Investments is the source of all data. All information contained in this material is current at the time of issue and, to the best of our knowledge, accurate. Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

Issued by Russell Investments Implementation Services Limited. Company No. 3049880. Registered in England and Wales with registered office at: Rex House, 10 Regent Street, London SW1Y 4PE. Telephone 020 7024 6000. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN. Russell Investments Limited is a Dubai International Financial Centre company which is regulated by the Dubai Financial Services Authority at: Office 4, Level 1, Gate Village Building 3, DIFC, PO Box 506591, Dubai UAE. Telephone + 971 4 578 7097. This material should only be marketed towards Professional Clients as defined by the DFSA. Russell Investments Ireland Limited. Company No. 213659. Registered in Ireland with registered office at: 78 Sir John Rogerson’s Quay, Dublin 2, Ireland. Authorised and regulated by the Central Bank of Ireland.

KvK number 67296386

© 1995-2020 Russell Investments Group, LLC. All rights reserved.

MCI-02178/17-03-2021