Tune out the noise: Toward a strategic asset allocation framework for private wealth investors

How can family office investors identify real growth opportunities in times of increased economic volatility? Multi-Asset Strategist Cara Lafond outlines how to tune out the noise to focus on long-term asset allocation.

KEY POINTS

• Investors should consider establishing a core growth allocation emphasizing high-conviction, benchmark-agnostic strategies centered on downside mitigation

• Complementing the core with a satellite allocation to strategies seeking exposure to areas of structural change in the global economy

• Setting a diversifier allocation with less sensitivity to equity-market movements may help support consistent lifestyle and philanthropic spending

• It may be prudent to maintain a modest position in stabilizers for purposes of liquidity and cushioning in flight-to-safety market environments

While the sleepy-volatility regime of 2017 may have lulled some investors into believing financial markets only go up, the abrupt return of volatility in 2018 has been a wake-up call, reminding people that capital appreciation is never risk free. In a choppy environment, we believe it is essential to tune out the noise and focus on a long-term asset allocation strategy. In this paper, we share our asset allocation framework for family office investors and identify where we are finding return opportunities.

At the core of our work with family offices, we seek to understand their needs, objectives, and risk tolerances. While no two families are alike, we do find similar threads that inform our investment strategy. For example, a common objective is often to fund philanthropic activities and to preserve and grow family asset bases for future generations. While a long-term horizon enables these investors to adopt a total-return mind-set and measure success over market cycles, understanding which economic environments may create tailwinds or headwinds for various strategies can help form more realistic performance expectations.

Further, we believe that to be successful stewards of family capital, private wealth investors must guard against drawdowns and behavioral biases that tempt them to deviate from long-term strategies at the worst possible times. This is a tall order in our current environment of rising interest rates, late-cycle dynamics, and divisive political discourse.

Designed to achieve investment objectives: The asset allocation framework

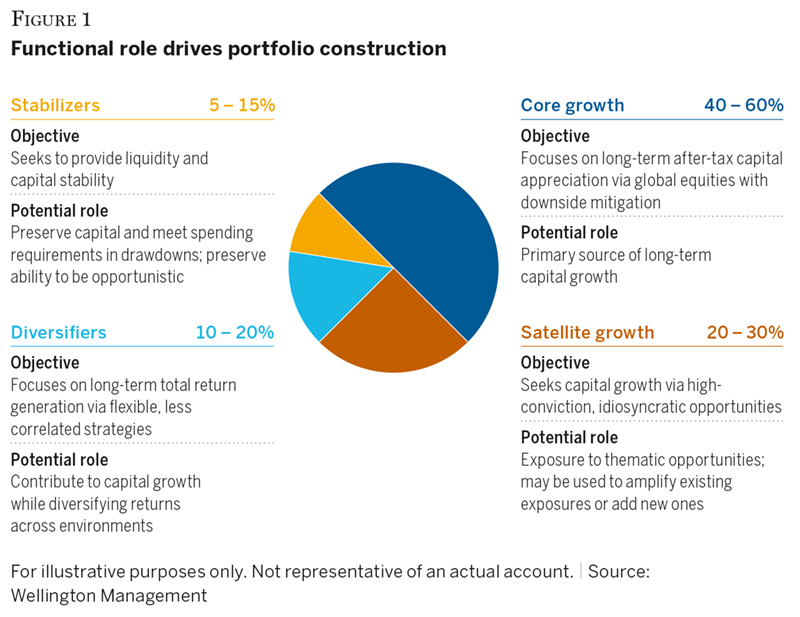

We propose a functional strategic asset allocation framework comprising four complementary exposures: core growth, satellite growth, diversifiers, and stabilizers (FIGURE 1). We view each building block as playing a specific role, with the overarching goal of providing a more consistent risk-and-return profile via diversification. We find the proposed positioning has the potential to be consistent with the investment objectives of long-horizon total return investors. Given the wide variation among family offices, it is vital to keep in mind the family’s life cycle, the degree of wealth concentration in an operating business, and whether or not the investment portfolio has a positive cash flow. Additional considerations could include the need for income and anticipated liquidity requirements.

When constructing the investment portfolio, rigorous quantitative analysis should be conducted to evaluate how well the components of the total portfolio complement one another. We scrutinize holdings to ensure there is low overlap, stress-test portfolios across various scenarios, and run market-environment and factor analyses to help us determine strategic weights and fit relative to other managers.

Core growth

Core growth

Objective: the equity “engine”

Structure core growth exposure to emphasize:

• Potential power of compounding via positive asymmetry

• High stock-specific risk

• Tax efficiency

• Global, all-cap orientation

Given the desire for long-term capital appreciation, family office investors often include equities as a central portfolio component, making equity risk a major contributor to overall risk. We structure our core growth allocation via exposure to strategies with histories of capital growth, downside mitigation, and tax efficiency. We feel this enduring approach enables investors to hold on to their return-seeking assets throughout the inevitable market gyrations.

After all, our primary aim with core growth is long-term, after-tax capital appreciation. We seek to achieve this by participating in up markets and mitigating drawdowns in challenging environments, the implication being that the timing of excess returns across a market cycle can have a significant impact on long-term compounding. Our research has shown that the ability to mitigate drawdowns, which helps preserve capital, can have a positive effect on long-term performance.

Another reason why a smoother ride matters is that it helps discourage the common behavioral bias of shifting to cash during market declines. Being patient and staying invested despite volatility may help mitigate erosion of principal and allow investors to take advantage of their long-term investment horizon. Market timing (jumping in and out to try to maximize short-term gains and minimize short-term losses) is notoriously hazardous and difficult to do consistently. The higher turnover also tends to create a tax drag, detracting from net returns.

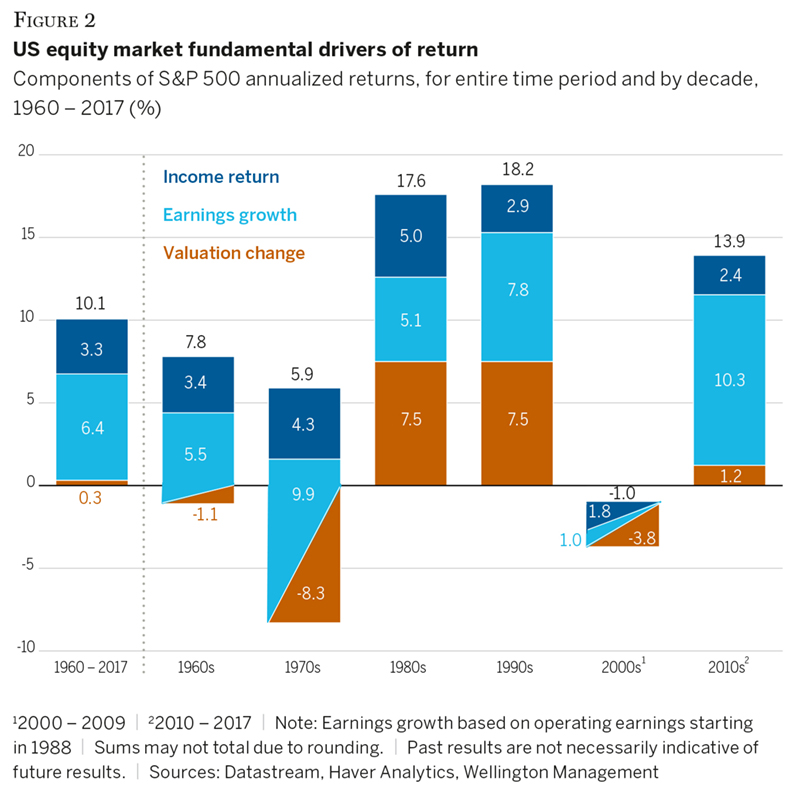

We believe, first, that stock-specific risk can be the key to enhancing after-tax performance, and second, that fundamentals matter over long horizons. When analyzing the sources of equity market returns over time, we find that earnings growth, not valuation expansion, is the principal driver of performance (FIGURE 2).

Within our core growth allocation, we prefer concentrated approaches run by managers who, in our view, are proven stock pickers who rely less on multiple expansion and more on differentiated, fundamental company insights for returns. By narrowing their holdings, they focus on their highest-conviction ideas — typically a small subset of their investable universe — rather than investing broadly on a benchmark-relative basis. Importantly, these managers are also patient, generally seeking to invest in competitively advantaged franchises, effective capital allocators, and attractively valued, stable return-on-capital growers. In other words, they seek to hold companies they are comfortable holding for the long term.

That brings us to another core tenet of our strategy selection research: It is the net return that matters. To maximize returns net of taxes, we seek to identify tax-efficient strategies, primarily by studying the nature of a strategy’s turnover over multiple years and market environments. We have found that low turnover, demonstrated ability to hold outperformers while promptly selling laggards, and a preference for dividend payers, can create tax efficiency.

Satellite growth

Objective: investing in areas with structural tailwinds

• Underrepresented in traditional exposures

• High return potential

• Differentiated return stream

The satellite growth allocation aims to provide exposure to differentiated capital market and thematic opportunities. Such positions may amplify existing exposures or add new ones to the portfolio. Within this allocation we are willing to accept a higher level of potential volatility to gain exposure to regions, sectors, or themes with long runways for growth. We integrate the expected level of risk as well as correlation with other positions into our portfolio construction model in an effort to appropriately calibrate the allocation size.

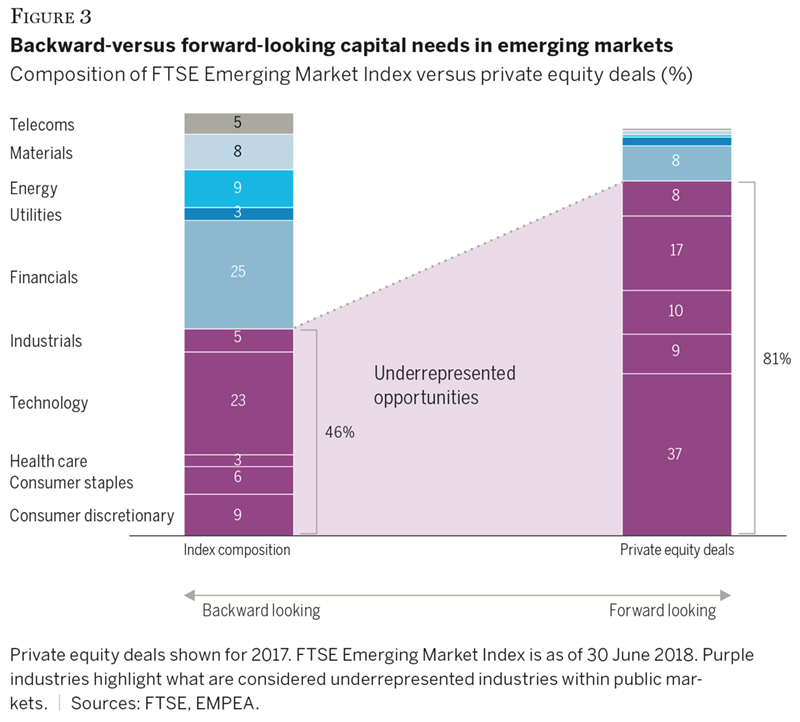

Today, one source of satellite growth exposure is emerging markets (EM), where opportunities are driven by structural economic development. As FIGURE 3 shows, new growth areas across EM are generally underrepresented in traditional indexes. Market indexes tend to be backward looking, making them a poor starting point when constructing a portfolio designed to capture future growth potential. We see opportunity in financial technology and automation, as well as in health care, discretionary services, and education, where we expect spending per capita to increase.

We are also increasingly focused on more targeted regional- and country-specific opportunities. For example, the gradual opening of the domestic Chinese A-share market allows foreign investors to access a diverse opportunity set that is generally uncorrelated to global equity markets. A-shares provide direct exposure to the dynamic Chinese economy.

We are also increasingly focused on more targeted regional- and country-specific opportunities. For example, the gradual opening of the domestic Chinese A-share market allows foreign investors to access a diverse opportunity set that is generally uncorrelated to global equity markets. A-shares provide direct exposure to the dynamic Chinese economy.

We believe A-share opportunities are wider and more liquid than H-shares, the internationally listed Chinese equity market. Most importantly, for long-term investors focused on organic growth prospects and management quality, we see a fertile market for active management that will continue to attract foreign capital for years to come.

Within all of our exposures, but particularly in satellite growth, we carefully consider how to ensure that the size of the position matches the opportunity set and economic backdrop. For example, equity long/short funds are compelling when there is wide return dispersion within an opportunity set.

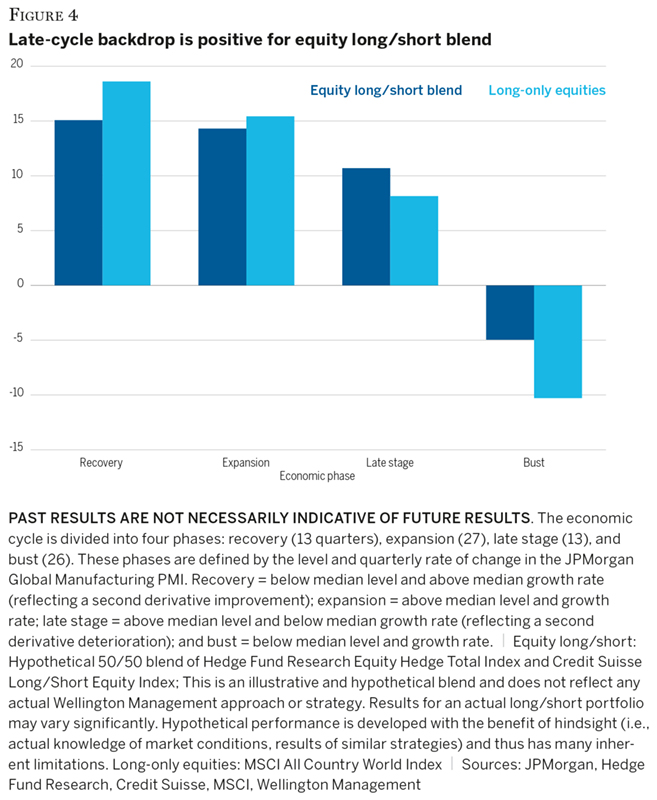

During the late stage of the economic cycle, our research also suggests that long/short equity approaches, with their ability to modulate net exposure and take calculated risks designed to generate alpha in up or down markets, have historically outperformed long-only equities (FIGURE 4). Today, we are excited about the major technological advances now being made in mobile payments, medical technologies, and cloud computing, as well as the opportunities being presented by disruption in the consumer space. We are positioning client portfolios accordingly with allocations to financial, health care, technology, and consumer long/short strategies.

We are also looking into dedicated private market exposure to these themes. Companies are staying private longer for a number of reasons. Increased regulation has raised the burden of going public, structural changes in the public markets generally benefit larger companies, and more mature businesses have a history of strong post-IPO performance. As a result, small-cap growth companies are less available in the public market.

We are also looking into dedicated private market exposure to these themes. Companies are staying private longer for a number of reasons. Increased regulation has raised the burden of going public, structural changes in the public markets generally benefit larger companies, and more mature businesses have a history of strong post-IPO performance. As a result, small-cap growth companies are less available in the public market.

Less than 25% of the Russell 2000 Growth Index has a sub-US$1 billion market cap (as of 30 June 2018). As a result, we find late-stage private exposures worthy of consideration for the satellite growth allocation. Such strategies look to invest in growth companies that are seeking strategic capital to move to the next phase of development and are typically one to three years away from a potential liquidity event.

Family offices and related foundations are at the forefront of the growing trend to integrate values and investment strategy through values-aligned investments pertaining to climate or social impact. Impact (or mission-related) strategies are focused, specifically investing with an intention to generate a measurable, beneficial social and/or environmental impact alongside a financial return.

Family offices and related foundations are at the forefront of the growing trend to integrate values and investment strategy through values-aligned investments pertaining to climate or social impact. Impact (or mission-related) strategies are focused, specifically investing with an intention to generate a measurable, beneficial social and/or environmental impact alongside a financial return.

Metrics such as “key performance indicators” are used to quantify impact and may reference such data points as jobs created or reduction in carbon footprint. There is a growing body of academic research suggesting that sustainable investments do not need to be concessionary. Such investments may also provide an opportunity for family cohesion around a common cause and help to engage younger generations in the investment discussion.

Diversifiers

Objective: smoothing the way

Goal of contributing to capital growth while diversifying returns across environments

• History of low correlation to traditional equities

• Low/variable beta

For family office investors aiming to avoid erosion of principal and maintain a stream of real income, we believe it is vital to incorporate strategies with less sensitivity to equity-market movements.

Within the diversifier allocation, we currently favor exposure to publicly listed infrastructure stocks, emphasizing regulated utilities, transportation, and midstream energy companies with long-lived physical assets that possess a potentially advantaged competitive position. We find such strategies to be attractive relative to the narrower master limited partnership (MLP) space. Public infrastructure strategies typically offer an attractive dividend and low earnings volatility, and they can provide greater diversification across sectors and geographies with less exposure to commodity markets. We find that these investments have exhibited modest correlations to overall equity markets and to other, more income-oriented asset classes over time.

Real estate is another source of wealth for most family office investors. Amid rising interest rates and normalizing inflation, we prefer short-cycle real estate subsectors such as multifamily units and hotels for their low duration and frequent lease resets, which allow realized inflation to be passed on to consumers. We also prefer flexible, lower-correlated exposures with a high degree of active risk as opposed to duration risk given the US Federal Reserve’s (Fed’s) tightening cycle. For example, market-neutral absolute-return strategies and variable-beta multi-strategy approaches may contribute to capital growth while diversifying returns across environments.

Stabilizers

Objective: liquidity

• Provide liquidity

• Preserve ability to be opportunistic

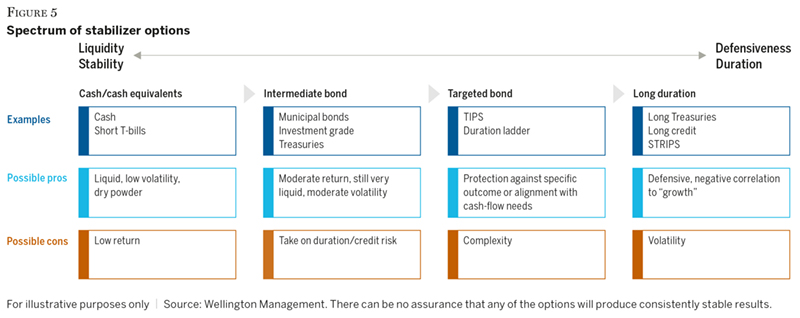

We observe that many family offices have reduced their exposures to traditional fixed income strategies more so than any other asset class. That is not surprising, given the importance of capital preservation and an uncertain outlook for fixed income returns as the Fed normalizes interest rates. We take a broader approach to assets that can act as stabilizers, from traditional cash-like instruments to bonds with more duration, TIPS, municipal bonds, and laddered maturity bonds (FIGURE 5). We retain a modest position in high-quality municipal bonds and cash for liquidity and cushioning in the event of a high-stress or flight-to-safety market environment. For investors with predictable cash needs, laddered municipal bonds may also play a role. We find the optionality value of holding cash to be valuable in today's stretched valuation regime.

Asset/mortgage-backed securities risk – The risks of investing in mortgage-related and other asset-backed securities include interest rate, extension, prepayment and credit risk.

Common stock risk – Equity markets are volatile and can decline in response to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues as well as the profitability and viability of the individual company.

Concentration risk – Concentration of investments in a relatively small number of securities may significantly affect performance. The investments may move in the same direction in reaction to the conditions of the industries, sectors, countries and regions of investment, and a single security could have a significant impact on the portfolio’s risk and returns.

Credit risk – The value of a fixed income security may decline due to an increased risk that the issuer or guarantor of that security may fail to pay interest or principal when due, as a result of adverse changes to the issuer’s or guarantor’s financial status and/or business. In general, lower-rated securities carry a greater degree of credit risk than higher-rated securities.

Currency risk – Investments in currencies, currency futures contracts, forward currency exchange contracts or similar instruments, as well as in securities that are denominated in a currency other than the investor’s base currency, are subject to the risk that the value of a particular currency will change in relation to one or more other currencies. Currency markets can be volatile, and may fluctuate over short periods of time.

Emerging markets risk – Investments in international markets may present risks such as changes in currency exchange rates; less liquid markets and less available information; less government supervision of exchanges, brokers, and issuers; increased social, economic, and political uncertainty; and greater price volatility. These risks are likely significantly greater in emerging markets relative to developed markets.

Fixed income securities risk – Fixed income security market values are subject to many factors, including economic conditions, government regulations, market sentiment, and local and international political events. In addition, the market value of fixed income securities will fluctuate in response to changes in interest rates, and the creditworthiness of the issuer.

Interest-rate risk – Generally, the value of fixed income securities will change inversely with changes in interest rates. The risk that changes in interest rates will adversely affect fixed income investments will be greater for longer-term fixed income securities than for shorter-term fixed income securities.

Liquidity risk – Investments with low liquidity may experience market value volatility because they are thinly traded (such as small cap and private equity or private placement bonds). Since there is no guarantee that these securities could be sold at fair value, sales may occur at a discount. In the event of a full liquidation, these securities may need to be held after liquidation date.

Smaller-capitalization stock risk – The share prices of small- and mid-cap companies may exhibit greater volatility than the share prices of larger capitalization companies. In addition, shares of small- and mid-cap companies are often less liquid than larger capitalization companies.

Cara Lafond (above, top right) is a Multi-Asset Strategist at Wellington Management. She conducts research on investment policy and portfolio construction in order to assist family-office, foundation, and endowment clients with long-term strategy. She also manages customized portfolios for clients seeking specific investment outcomes.

Visit Wellington Management for more information and contact details.