Thematic trends: New ways to diversify and search for long term value

Why do you think that thematic trends are more important or in any way better than a simple value approach, that has been successfully implemented by Warren Buffett and multiple other investors over the years?

Of course, I agree that a value approach is something that has proved itself for many successful investors. But in a new era of algorithms and machines this approach became too popular. In many other smart-beta cases, the most profitable opportunities have been taken away by hundreds of investors with the same logic. The Wall Street Journal quoted Charlie Munger’s idea that you need to be fishing where nobody is fishing.

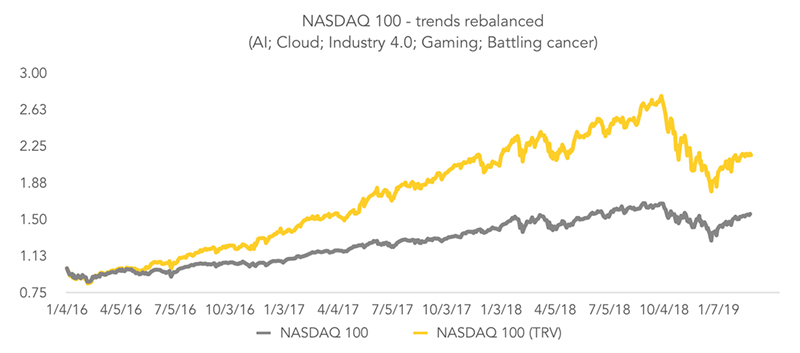

Our initial results show that thematic trends might be a new area of search for above-the-market returns. Particularly in the coming era of low equity returns, which all the analysts and asset managers envision in the next decade. For me, the trend is a more stable and stronger driver than even value criteria on a company level. Even more so if you think about the portfolio with the key driver or factor. It does not mean that we should ignore value screen altogether.

But as we read in the business media these thematic trends seem to be very well covered by exchange-traded funds (ETFs)?

We continuously monitor the universe of thematic ETFs which are available. There was indeed a huge growth of ETFs in this area in terms of a number. Yet the amount of money under management still remains immaterial compared to other ETFs, with very few exceptions. Our view is that it is developing this way because most ETF providers use it more for pure marketing purposes, rather than a real investment instrument. And the key problem here is that such thematic ETFs are deploying similar approaches and end up either with an excessive number of companies in its holdings or a very limited number.

Another important fact is that there are still very few ETFs in this niche built from and for institutional investors. Our trend rebalancing methodology might be very useful to resolve this problem.

Why do you think your portfolios are better than such ETFs?

Because we use several approaches simultaneously to a very wide universe of stocks. And results of some comparisons and back-tests are very promising. Obviously this is not a guarantee of future returns, but we understand and are ready to discuss with our clients how to implement certain approaches to capture additional returns from thematic factors. We are currently testing our TRV index, which will provide them with even more actionability.

Provided that we have a historical data on composition of ETF, we have functionality to compare any given ETF with our portfolios and, if you have your own portfolio, to dive deeper into its thematic aspect. We want to make it easier for analysts, portfolio managers, or investors to analyse thematic trends and our tool is a powerful tool for that.

What is the key value you think your potential clients get?

What is the key value you think your potential clients get?

I think we open a door to more structured analysis of the whole universe of US-listed public equities, with global equities coming next quarter. We start with the proprietary AI/ML algorithms analysing public information about equities and then filter trend lists through certain financial, qualitative, sentimental screens that allow the user to get better positioning of the company in a trend, or a view of trends in a company and its peers. Our library of trends comprises more than 50 trends. Of course there is a functionality to research unique trends as defined by the client. We believe diversification through trends might be better than by industries. This opportunity to create portfolios with a proprietary mix of trends might be appealing.

What are your further product development goals?

Our tool is a powerful research platform that can save a lot of time and give

new ideas on where to look for opportunities. We can provide extensive lists of companies influenced by the trends in seconds. We have extensive an library of investable trends, which means that there are equities that investors can consider to invest into the trend. Our next milestone will be a release of our TRV index in April.

We still are building a global coverage functionality on publicly available data, which is quite challenging due to very diverse reporting standards. But it is not a problem for those clients who use well-known financial data providers as we can easily work on their data.

Our vision is to build an investment analytics company on the back of our sophisticated proprietary algorithms and approaches that can analyse and measure key global trends to help the investment community better navigate this area in application to public markets. We have developed something unique and very valuable for thematic trends investors.