Global Family Office Report 2016: Forward looking - Reading the runes

The Global Family Office Report stops short of offering advice—instead the reader must interpret its objective data. In this concluding article, research director Stuart Rutherford and UBS family office head Philip Higson share their personal views on the future focus for family offices

Predicting the future is a dangerous game for a researcher, particularly in the family office sector, where the stakes are often high. For the team behind Campden Wealth's Global Family Office Report, the risk of forecasting was simply too high. That said, the report's leaders formed personal opinions on the future of family offices.

“Succession will always be a problem for family offices,” explains Philip Higson, vice chairman of UBS's global family office group.

“But in my view, we have also got the issue of cost consciousness. If you are one of the family offices that had worse returns than last year—and that is the case for most offices—you had better be clear about what you are spending your money on.”

“But in my view, we have also got the issue of cost consciousness. If you are one of the family offices that had worse returns than last year—and that is the case for most offices—you had better be clear about what you are spending your money on.”

One of the most revealing findings in the Global Family Office Report 2015 was that total operating costs of family offices had jumped by some seven basis points of assets under management compared with the previous year. Participants in this year's report have taken this to heart: more than a third of offices were more or significantly more cost conscious than they were 12-months ago.

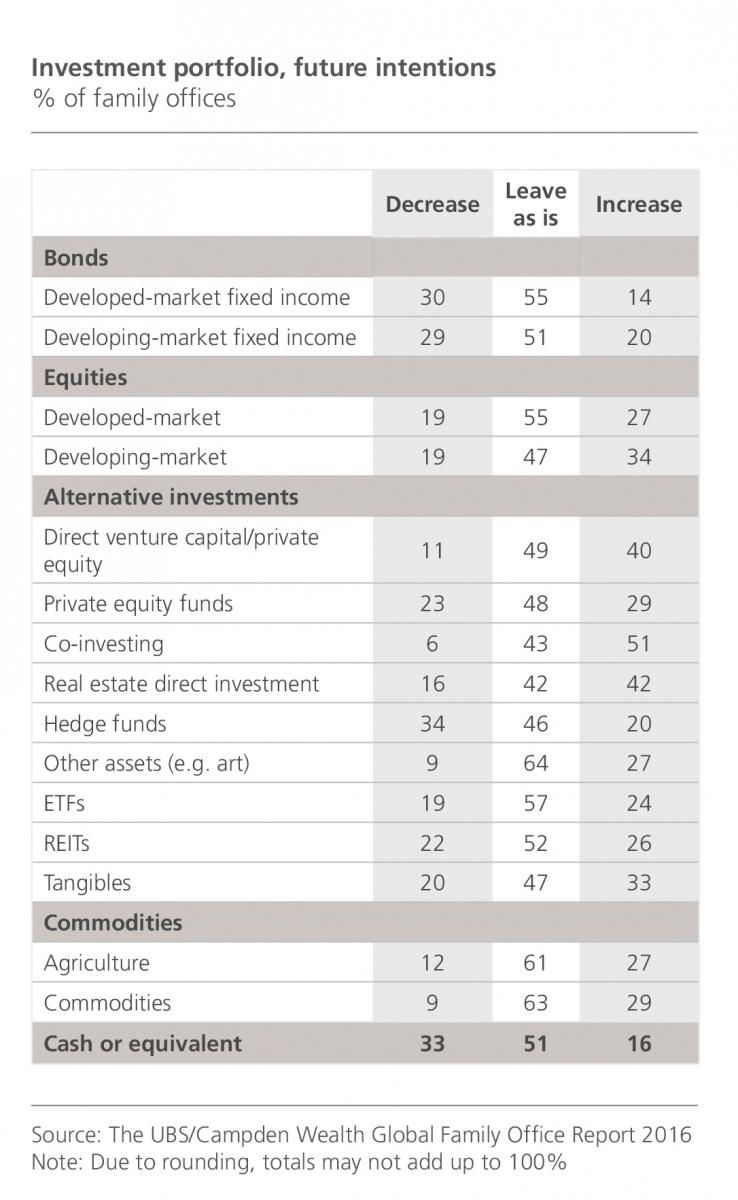

In addition to costs, the dangers of pinning future expectations on past performance is an issue also highlighted in the Global Family Office Report, most notably in offices' over reliance of private equity and real estate in their portfolios.

In addition to costs, the dangers of pinning future expectations on past performance is an issue also highlighted in the Global Family Office Report, most notably in offices' over reliance of private equity and real estate in their portfolios.

Higson warns offices must be wary of their allocations: “For real estate, the lower-for-longer interest rate scenario keeps benefiting family offices year-on-year, because returns are bond-like. Although the American Federal Reserve is talking about raising rates, they actually have not done anything yet. All the other central banks around the world also remain very accommodative.”

Higson says 2017 is likely to be a good year for real estate thanks to the low cost of borrowing. However, he warns against investing in residential, high-end apartments, and penthouses, which are likely to suffer thanks to government policy that is driving up stamp duty and taxation.

“On private equity, a material change in the price of energy would undermine the asset class,” Higson continues.

“So if energy was to hit a new low, what I believe will happen is that it is going to trigger a lot more stress around bond markets, particularly funding for buyouts. That will create a whole chain reaction that might undermine the funding for private equity in general, and make credit more difficult to come by. This credit helps unlisted companies generate returns. So it is important to be cognisant of the energy discussion”.

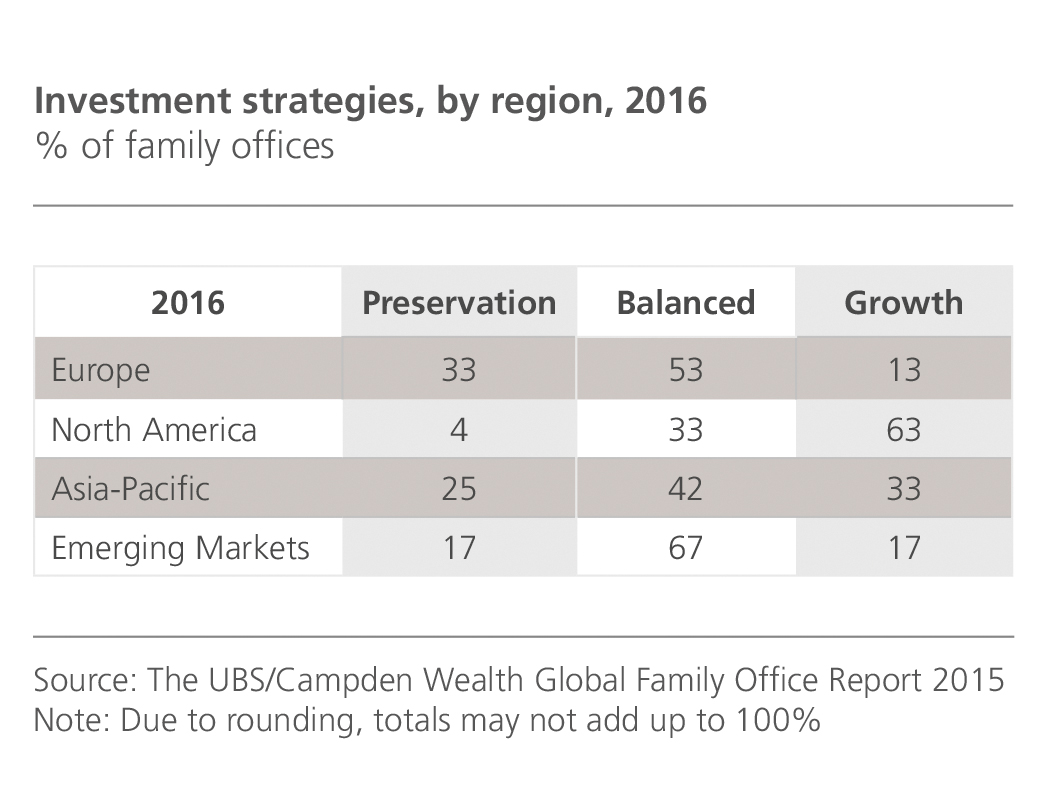

For Stuart Rutherford, head of research at Campden Wealth, one of the main areas family offices should focus on as they move into 2017 is endowments: designed to keep the principal amount intact while using the investment income from dividends for charitable efforts, endowments have significantly outperformed family office portfolios for three years.

“It is a reminder that offices need to sense check their own allocations to make sure that they are comfortable with their stance,” Rutherford explains.

“It is a reminder that offices need to sense check their own allocations to make sure that they are comfortable with their stance,” Rutherford explains.

“They must also be sure that the kind of trade-offs in returns that perhaps they get from holding more liquid assets are merited. From a cost point of view, I think family offices are more actively managing that, and I think they would do well to more actively manage that as they move forward.”

According to the report, one key difference is family offices' lower allocations to fixed income and cash. Families may well want to consider whether they need as much of this 'just-in-case' liquidity in their portfolios—recognising that cash will also be held within many underlying companies and funds. Rethinking the scale of these 'safe' holdings, or more actively managing them through sensible financial planning, could allow family offices to make their portfolios much more productive over the long-term, the report read.

“I think succession is probably the single biggest challenge facing family offices over the next decade,” Rutherford concludes.

“I think succession is probably the single biggest challenge facing family offices over the next decade,” Rutherford concludes.

“For all family offices, but particularly the 69% that are going to transition in the next 15 years, they need to be developing and implementing really well thought through plans. In the report we cover five areas that are of upmost importance: involving the next generation, ensuring that the older generation get involved and transfer power, make and ensure the family office is flexible, and ensure corporate governance is effective. Mostly, they must try to encourage good family relationships as much as possible. Those are the big issues.”

While Higson and Rutherford are happy to share their thoughts on how family offices will fare over the next few years, the future is fluid. As Abraham Lincoln, 16th president of the United States, said: “The best way to predict the future is to create it.”

Find out more about the Global Family Office Report 2016 at www.globalfamilyofficereport.com