Family office growth rockets but succession planning lags in India

Family offices are being embraced by India’s wealthiest $2 trillion families, but few families have a robust succession plan in place to secure their fortunes.

The world’s first study on India’s nascent family office space, released by Campden Research today, found more than half (58%) of Indian families surveyed were interested in setting up, or joining, a family office to manage, preserve and grow their wealth. Half (50%) said they were in the process of establishing their own family office.

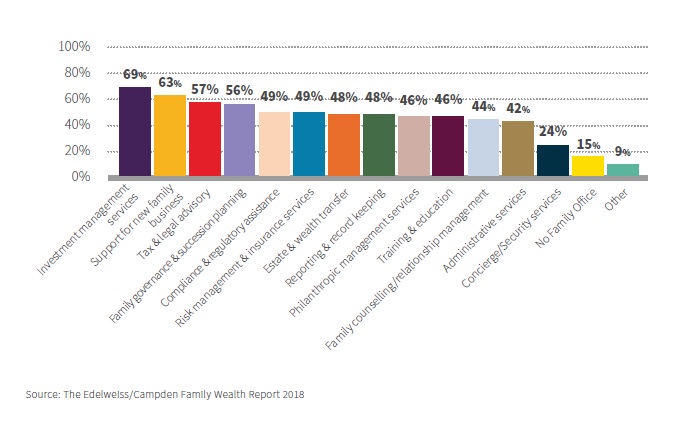

Just over half (53%) of families founded their offices to professionalise their family business and investment structures. Family offices enabled co-investing opportunities for 38% of families surveyed. Fixed income and equities were their two most favoured asset classes for investments, with interest expressed in private equity and venture capital opportunities.

India remained the focus for family investment with 99% of families investing in the country.

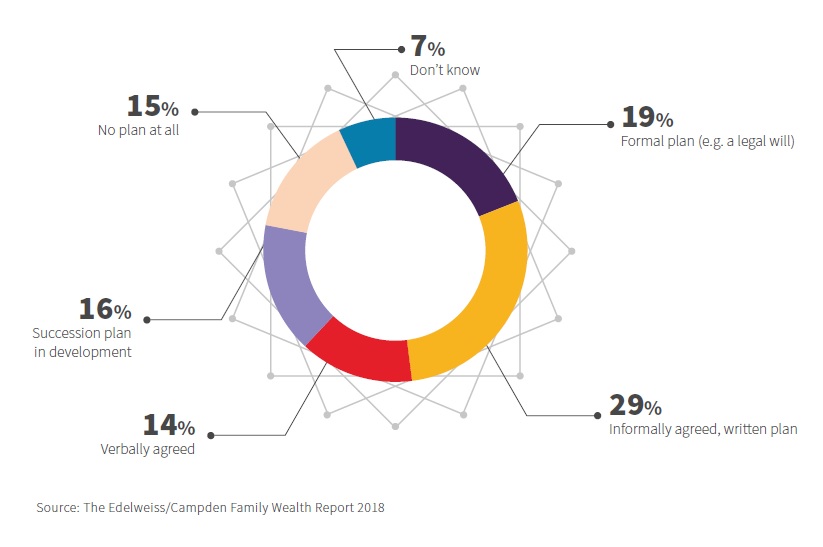

A total of 44% of families said they started their family office to successfully transfer wealth between generations. The next generation was coming on board—56% already held family office or wealth management roles. However, only 19% of the families in India had a formally agreed written succession plan in place. A further 29% had informally agreed written plans while 14% had verbally agreed plans and 15% had no plan at all.

The UHNW population in India grew by 290% in 2006-16 and it is predicted India will produce on average 1,000 UHNW individuals a year over the next decade. India has the sixth largest economy globally and is expected to be the second largest economy by 2050.

The UHNW population in India grew by 290% in 2006-16 and it is predicted India will produce on average 1,000 UHNW individuals a year over the next decade. India has the sixth largest economy globally and is expected to be the second largest economy by 2050.

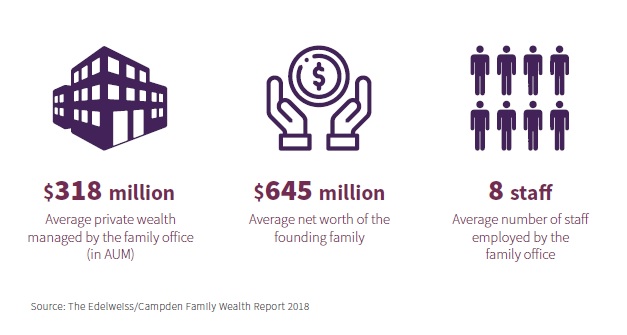

Almost 80 ultra-high net worth (UHNW) families with an average net worth of $645 million and $318 million assets under management were studied by Campden Research for its new report The Family Wealth Report 2018: A Roadmap for the Indian Family Office.

CampdenFB launched a supplemental magazine on the family office space in India alongside the debut report at the Indian Family Office Conference, organised by Campden Family Connect, a joint venture between Campden Wealth and the Patni family, with Edelweiss Private Wealth Management.

CampdenFB launched a supplemental magazine on the family office space in India alongside the debut report at the Indian Family Office Conference, organised by Campden Family Connect, a joint venture between Campden Wealth and the Patni family, with Edelweiss Private Wealth Management.

Amit Patni, director of Campden Family Connect, said India had witnessed the generation of vast sums of personal wealth, thanks to the sales of assets, exits from family businesses and the economic growth of the country.

“Consequently, family offices are becoming increasingly popular in India,” Patni said.

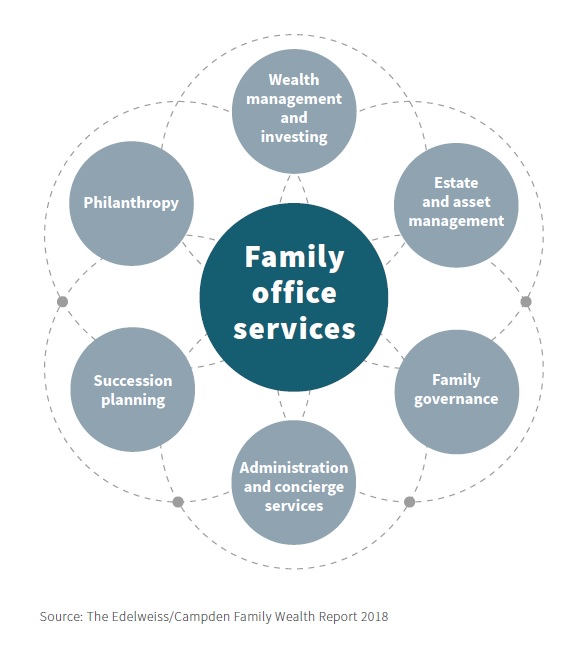

“However, the fact that there are only about 45 formal family office structures in existence demonstrates a dearth of understanding on the purpose and services offered by family offices.”

“However, the fact that there are only about 45 formal family office structures in existence demonstrates a dearth of understanding on the purpose and services offered by family offices.”

Anshu Kapoor, head of private wealth management at Edelweiss, said India had about 150,000 high net worth (HNW) families with a cumulative net worth of $2 trillion. This number was expected to rise to 400,000 HNW families with a net worth of $5 trillion by 2025.

“We are witnessing openness from these families to the concept of a family office beyond traditional wealth management. Collaborating with partners like Campden to conduct such research activities is in sync with our core philosophy of listening to our clients/potential clients and constantly evolving ourselves to cater to their needs.”