Cryptoassets in a portfolio theory context

Monetary policy and a very successful investment decade

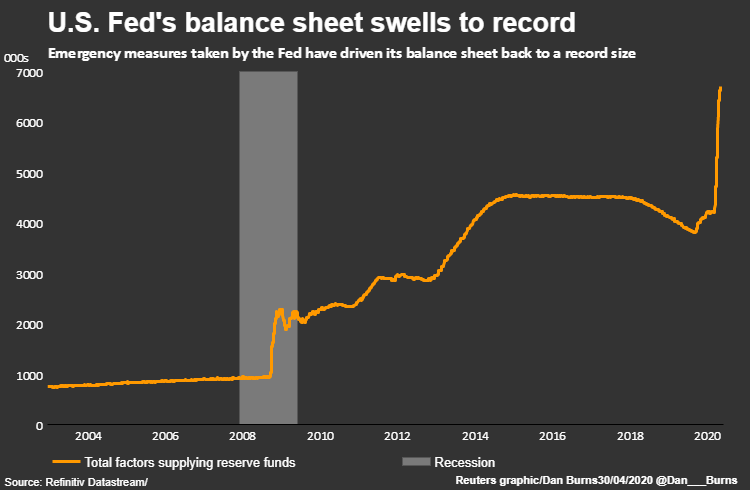

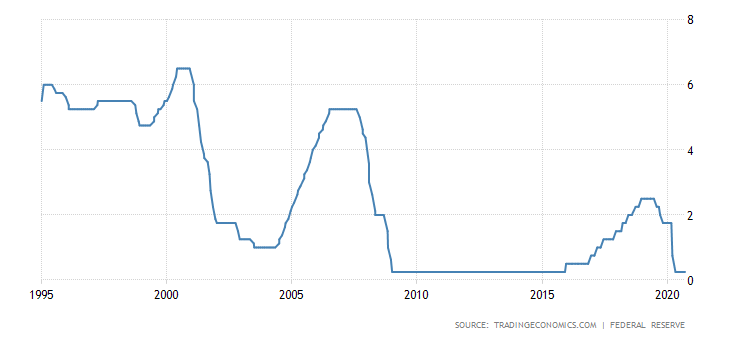

The past decade has been one of the most successful investment decades in history: US stocks rose by an average of 248%, the US real estate market by 200%, and gold as a “safe haven” climbed by 40%. The loose monetary policy as a result of the financial crisis has certainly contributed a great deal to this trend, as alternatives such as saving accounts or life insurance are simply no longer an option in times of low interest rates and increased monetary supply.

The two graphs below illustrate this phenomenon very well.

Source: Reuters

Source: Trading Economics

Even today, in the times of the corona crisis, the rally seems to have no end. But where else should money flow?

Cryptoassets as an allocation—why?

Savvy investors now know that Bitcoin was the best investment of the last decade, and that cryptoassets are the fastest growing asset class today. Nevertheless, the question arises whether it is worth the risk an investor has to take based on its volatility and other factors. Having already written about the best way to invest in cryptoassets and the distinct value drivers of various cryptoassets, today’s topic is exactly this: does it make sense from a portfolio theory point of view to include crypto? Why do star investors and billionaires like Mike Novogratz, the Wiklevoss twins or Paul Tudor Jones talk so enthusiastically about this asset class?

As a Chartered Alternative Investment Analyst (CAIA), I wanted to find out what effect an allocation of crypto has on different types of portfolios, such as the Norway model, the Family Office model or the Endowment Model. It was important not only to look at the increasing alpha (obviously, considering that this is the best performing asset in recent years), but to focus especially on the Sharpe Ratio and thus on the beta (systemic risk).

Which types of portfolios benefit most from crypto

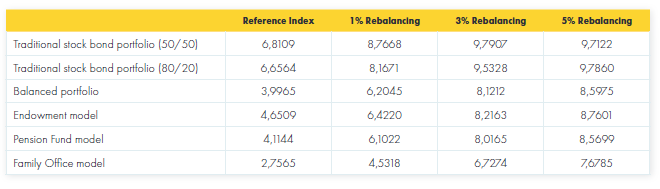

In short, each portfolio benefits from an allocation, not only in terms of performance (alpha), but also in terms of the risk/return ratio, measured in the Sharpe Ratio.

This is particularly astonishing considering that this is a highly volatile asset class. Volatility is punished in portfolio theory and it takes quite a bit to increase the Sharpe Ratio, nevertheless. It is only through this increase that an asset legitimises itself as an addition to a balanced portfolio.

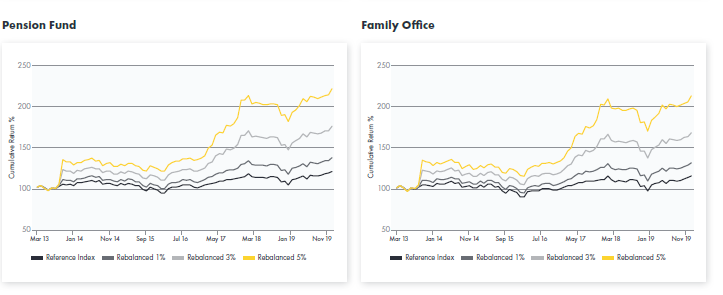

Family offices and pension funds benefit most from a 5% allocation of cryptoassets in their portfolio. The Sharpe Ratio for a pension fund doubles and that of a family office even increases by 180%, which is almost triple. The increasing performance, the additionally generated alpha, is well illustrated by the following graph:

The annualised performance of the respective portfolios would even have quadrupled or quintupled in this period. And that is only with a 5% admixture of a crypto index.

Key takeaways

So, what are our conclusions?

· Investing part of your assets in cryptoassets makes sense from a portfolio theory perspective. And not only in terms of performance, but also in a risk-return context.

· Excessive money printing in the context of expansive monetary policy seems to continue to fuel the markets as there is a lack of alternatives. Stocks and real estate as well as cryptoassets benefit from this.

· Cryptoassets are a distinct asset class and as such, also due to their low correlation, they should be at least a minor component of any portfolio

· “The greatest risk of cryptoassets is not owning any”

The full report with exact results and details of the methodology can be downloaded here. Or book your free workshop, which covers all topics related to blockchain and crypto, here.

Legal Disclaimer

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.